Dubai, 6 Ağustos 2025 (Qahwa World) - Uluslararası Kahve Örgütü'nün (ICO) son Kahve Piyasası Raporu'na göre, küresel kahve fiyatları Temmuz 2025'te keskin bir düşüş yaşadı ve tüm büyük kahve gruplarında çift haneli daralmalar görüldü. Hem gelişen arz temellerini hem de artan küresel ekonomik belirsizliği yansıtan gerileme, piyasanın 2024/25 kahve yılında öngörülen arz fazlasına ve uluslararası ticaret politikasında devam eden aksaklıklara uyum sağlamasıyla ortaya çıktı.

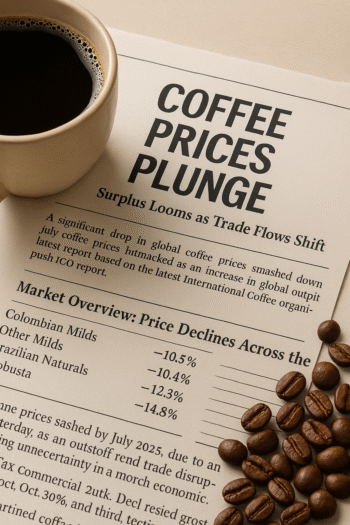

Market Overview: Prices Fall Across the Board

The ICO Composite Indicator Price (I-CIP) averaged 259.31 US cents/lb in July — an 11.8% drop from the previous month. While the year-on-year average remains 9.6% higher than July 2024, the downward trajectory is evident, with the price trending between 252.46 and 269.57 US cents/lb throughout the month.

Breaking down the group averages:

-

Colombian Milds fell to 322.37 US cents/lb (−10.5%)

-

Other Milds dropped to 325.50 US cents/lb (−10.4%)

-

Brazilian Naturals declined to 297.04 US cents/lb (−12.3%)

-

Robustas saw the steepest fall, tumbling to 167.19 US cents/lb (−14.8%)

The declines were echoed in the futures markets. New York ICE prices dropped 12.3% to 289.17 US cents/lb, a nine-month low, while London ICE fell 16.3% to 153.43 US cents/lb.

Key Market Pressures: Supply Surplus and Tariff Tensions

Several converging factors contributed to the bearish price movement:

-

Surplus Expectations: The 2024/25 coffee year is projected to be in surplus, with improved output from major producers.

-

Brazil’s Accelerated Harvest: As of July 23, Brazil’s harvest was 84% complete, ahead of last year’s pace.

-

Tariff Anxiety: New U.S. import tariffs have cast a shadow over trade flows. The UK-based National Institute of Economic and Social Research (NIESR) forecasts a potential 1.1% reduction in global GDP by 2030 if the current tariff regime persists.

-

Inventory Buildup: Certified stocks of Robusta coffee in London surged by 35.8%, reaching 1.18 million bags, while Arabica stocks in New York fell 8.1% to 0.83 million bags.

Volatilite ve Farklılıklar: Akışkan Bir Piyasa

I-CIP'deki volatilite hafif bir düşüşle %10,2'ye gerilerken, Robusta volatilitesi %10,3'ten %13,1'e sıçradı. Vadeli işlem piyasası oynaklığı da özellikle Londra'da arttı (6,1 puan artışla %16,6'ya yükseldi).

Price differentials shifted notably:

-

Colombian Milds vs. Other Milds: Widened slightly to –3.13 US cents/lb

-

Colombian Milds vs. Brazilian Naturals: Up 17.5% to 25.32 US cents/lb

-

Colombian Milds vs. Robustas: Narrowed by 5.3%, averaging 155.17 US cents/lb

-

Brazilian Naturals vs. Robustas: Also tightened by 8.8% to 129.85 US cents/lb

-

The London–New York arbitrage narrowed 7.2% to 135.74 US cents/lb

Export Performance: Trade Rebounds, But Regional Divergence Grows

Despite price weakness, global green coffee exports grew 3.3% year-on-year in June 2025 to reach 10.23 million bags, marking the second consecutive month of positive growth. However, year-to-date green bean exports remain down 3.0%, at 91.68 million bags compared to 94.52 million over the same period last year.

By coffee group:

-

Other Milds: +14.8% (2.71 million bags)

-

Colombian Milds: +9.0% (1.1 million bags)

-

Robustas: +16.9% (3.92 million bags)

-

Brazilian Naturals: –21.3% (2.51 million bags), with Brazil’s own exports plummeting 28.9%

Arabica’s share of total green bean exports increased to 62.9%, up from 61.4% a year earlier.

Regional Export Trends: Asia and Africa Rise as South America Retreats

Exports of all coffee forms totaled 11.69 million bags in June, up 7.3% year-on-year.

-

Asia & Oceania: Surged 38.6% to 3.34 million bags, led by Vietnam (+64.6%) and Indonesia (+63.2%)

-

Africa: Grew 28.1% to 2.19 million bags, driven by Uganda (+51.4%) and Ethiopia (+15.0%)

-

Mexico & Central America: Rose 18.0% to 2.0 million bags, with Nicaragua leading (+50.6%)

-

South America: Slumped 18.1% to 4.16 million bags, with Brazil falling 31.4% — the eighth straight month of contraction

Soluble and Roasted Coffee Exports Surge

-

Soluble coffee exports rose 47.2% in June to 1.35 million bags, making up 11.5% of total exports so far this coffee year.

-

Brezilya 0,30 milyon torba ile lider

-

-

Roasted coffee exports increased 58.1% to 0.08 million bags

ICE Launches New Arabica Contract

Starting 8 September 2025, ICE Futures US will introduce a new 10-tonne Arabica Coffee “C” Metric Contract (symbol AC). Eligible origins include Brazil, Vietnam, Colombia, Ethiopia, India, and 16 other countries, reflecting broader global integration into futures markets.

Outlook: A Market Redefining Itself

ICO'nun Temmuz 2025 raporu, jeopolitik dalgalanmanın ağırlığı ile arz kaynaklı fiyat ılımlılığı vaadi arasında sıkışmış, çok önemli bir kavşakta bulunan bir kahve piyasasının resmini çiziyor. Brezilya'nın olağanüstü 2023/24 sezonunun geride kalması ve Vietnam, Uganda, Endonezya ve Etiyopya'nın artan üretiminin ön plana çıkmasıyla geleneksel ticaret hiyerarşileri değişiyor.

Çözünebilir ve Robusta ihracatındaki keskin artış, muhtemelen maliyet duyarlılığı ve değişen tüketim alışkanlıklarıyla şekillenen, gelişen bir talep eğrisine işaret ediyor. Bu arada, yeni ICE Arabica kontratı kahvenin hedge edilme, ticaretinin yapılma ve sınır ötesine teslim edilme şeklinin yeniden yapılandırılmasına işaret ediyor.

As the 2024/25 coffee year nears its conclusion, stakeholders are watching closely: Will the surplus soften volatility, or will new macroeconomic shocks redraw the market map once again?

The post Ticaret Akışları Değişirken ve Fazlalıklar Ortaya Çıkarken Kahve Fiyatları Düşüyor: ICO'nun Temmuz 2025 Pazar Raporu Sektörün Yeniden Başladığına İşaret Ediyor appeared first on Qahwa World.